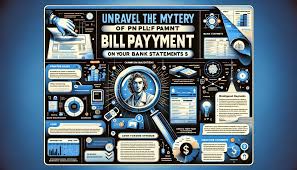

Introduction to PNP Billpayment Alert

Do you want to be free of failing to pay your bills on time or being charged extra fees? In that case, the PNP Billpayment Alert solves your problems. This innovative platform can change how you deal with your bills, thus giving you peace of mind and an organisational framework. Consider getting reminders in time to allow you to act before due dates arrive so you don’t have to rush at the last minute! Everything from the merits of this solution to myths about PNP Billpayment will be covered in this blog post. Now, let’s look at how it works and why it can make your financial life more manageable.

Benefits of Using

There are several advantages to using PNP Billpayment Alert, which would make your billing process more accessible. This would help you avoid being charged unnecessarily for late payments and ensure payments are made on time.

The service also makes managing multiple bills easy. You don’t need to switch between various platforms while dealing with different accounts.

Another notable advantage is enhanced financial planning. Regular alerts can help you better budget and allocate money more effectively monthly.

Further, the alert system promotes responsibility. Receiving prompts will assist you in managing your money and making clever choices about how to spend it.

It is easy to understand, so even a person without technical know-how can operate it.

That’s why it is an ideal tool for anyone who wants to simplify their bill management routine.

How to Enroll in PNP Billpayment Alert

Enrolling in the PNP Billpayment Alert is very smooth. To begin with, go to the website of your local police force or agency dealing with such matters. Navigate to the bill payment section.

Then, provide basic details about yourself, like name, address, and contacts. This guarantees personalised alerts sent straight to you.

Therefore, once you have keyed in this information, choose how you want to be notified: text or email. Ensure that these data are confirmed for consistency purposes.

Afterward, monitor your messages or inbox for a link or code confirming your application’s submission. If you follow these steps, you will have set yourself up to manage payments better using PNP Billpayment Alert at your fingertips!

Common Misconceptions About PNP Billpayment Alert

Several people need clarification about the PNP Billpayment Alert system. For example, they think it is restricted to bills such as utilities and loans. However, it can be used to manage different payments.

One of them is that it is complex to use. Nonetheless, the registration procedure is straightforward and convenient for all customers, even those who could be better with technology.

They fear that privacy concerns will compromise their financial data. However, PNP upholds confidentiality and has implemented measures to secure your information from unauthorised access.

Others believe that these alerts will overwhelm their phones with notifications. This implies that a user can select the way and frequency to deliver messages as they want. This means you only have a little information at once but are kept informed continuously on vital issues.

Tips for Maximizing the Use of PNP Billpayment Alert

Set up alarms for all your due dates to gain maximum benefits from the PNP Billpayment Alert. This is important in preventing missed payments, which can affect your credit rating.

If this feature is available, use the calendar. Sync it with your phone or paper planner to remind you of upcoming payments.

Keep reviewing bills within the app often. Please get to know those that recur so they do not surprise you.

Consider adding other accounts for ease of control. Consequently, you can monitor several statements at once on one platform.

Whenever necessary, engage customer support. They can offer custom advice to enhance your experience and swiftly fix any problem.

Security Measures and Privacy Concerns with PNP Billpayment Alert

When it comes to managing your bills, security comes first. PNP Billpayment Alert is committed to securing your private data. The system uses encryption technology to protect information during transmission.

Furthermore, two-factor authentication offers an extra layer of security. In addition to a password, you will require additional identification details, significantly reducing unauthorised access.

In today’s digital world, privacy concerns are justified. PNP does not allow third parties to access user data without the latter’s approval. Your payment details shall remain undisclosed and safe with reliable online payment providers like us.

Routine audits and updates ensure the system remains fortified against potential attacks. Being ahead of cyber threats is essential for any web-based service provider to maintain consumer trust.

If users know about these precautions, they may feel more secure when utilising PNP Billpayment Alert for their financial transactions. Also Read: 10 Things You Should Know When Choosing An Online Payment Gateway Provider

It is just as significant for individuals in every walk of life as it is for those who wish to pay through mobile apps or internet banking services.

Conclusion: Why You Should Consider Using PNP Billpayment Alert for Your Bills

The PNP Billpayment Alert system provides an easy and efficient means of managing bills. This service allows users to stay organised and avoid late fees, ensuring financial prudence. Enrolling is simple, making it available to everybody regardless of their technological know-how.

Therefore, some common misconceptions about the alert system need to be clarified. Many people may wrongly believe it is complex or insecure; however, if equipped with good information and security measures, one can readily use PNP Billpayment.

Understanding its practical utilisation and being conscious of privacy issues while maximising its benefits can help you feel a certain level of comfort when you know that you do not have payment issues.

Thus, embracing the PNP Billpayment Alert also implies adopting a more intelligent way to manage bills in which efficiency intersects with safety. As finance management advances in today’s fast-moving world, such tools become inevitable for anyone looking forward to making life easier.

FAQs:

Q: What is PNP Billpayment?

A: The PNP bill payment system reminds subscribers to ensure punctuality in bill payments and thus avoid penalties. Therefore, users will be reminded beforehand of their bill payments.

Q: How does PNP Billpayment help with financial planning?

A: PNP Billpayment assists with financial planning by providing regular reminders, which helps users budget effectively and avoid unnecessary charges.

Q: Is PNP Billpayment easy to use?

A: Yes, indeed, PNP Billpayment is designed to be user-friendly, with a straightforward registration method and understandable procedures.

Q: Can I use PNP Billpayment for different types of bills?

A: Absolutely! PNP Billpayment can manage various bills, not just utilities and loans, making it versatile for all your payment needs.